Explore whether tax cuts or government spending drive stronger U.S. growth in 2025. Discover expert insights, data, FAQs, and balanced fiscal strategies.

In 2025, America’s economic future hangs between tax cuts and government spending. Which policy fuels lasting prosperity? This in-depth analysis unpacks the real-world data, fiscal debates, expert views, and practical implications shaping the nation’s growth strategy this year.

In 2025, the fiscal tug-of-war between tax cuts and government spending is more intense than ever. While tax relief aims to boost private-sector growth, massive government outlays seek to power infrastructure, innovation, and social safety nets. The winning formula lies not in one extreme, but in balance—combining strategic tax policy, productive public investment, and disciplined debt management to drive equitable and sustainable growth.

The 2025 Fiscal Crossroads

The U.S. economy stands at a defining moment. With slowing GDP growth, inflation uncertainty, and record federal debt levels, policymakers face a core dilemma:

Should the government focus on cutting taxes to stimulate business, or on spending to build public value?

Both tools—tax policy and public expenditure—have deep roots in American fiscal philosophy. Tax cuts promise dynamism and individual freedom, while spending programs deliver infrastructure, opportunity, and safety nets.

Yet 2025’s environment is unlike past decades: debt exceeds 100 % of GDP, interest payments consume a growing share of the federal budget, and global competition demands smarter—not just bigger—spending.

Why This Debate Matters Now

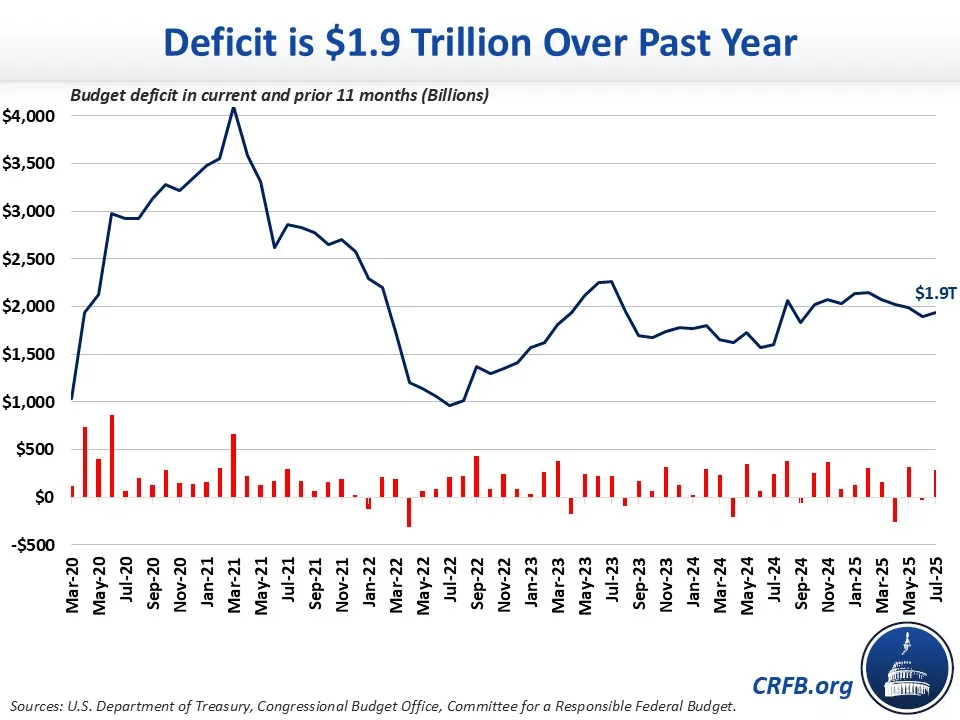

Source: Committee for a Responsible Federal Budget

Key numbers framing 2025:

- Budget deficit: ≈ $1.9 trillion (≈ 6.2 % of GDP) — CBO Estimate

- Spending vs revenue: Outlays ≈ 24 % of GDP, revenues ≈ 18 % (average 2026–2035)

- Interest costs: Rising rapidly, threatening to crowd out investment

Every decision about tax cuts or new programs feeds into this equation. Neither policy lever is free; both carry growth potential and fiscal risk.

Defining the Terms: Tax Cuts & Government Spending

Tax Cuts reduce the burden on individuals or businesses—via lower rates, higher deductions, or credits—to boost disposable income and investment.

➡ Example: The Tax Cuts and Jobs Act (TCJA) extensions under review in 2025.

Government Spending covers public outlays—defense, infrastructure, healthcare, education, and social programs.

➡ Example: Federal net borrowing in Q1 2025 ≈ $2 trillion (BEA.gov).

The real challenge? Using both tools wisely to balance growth, equity, and debt sustainability.

What Happens When Taxes Are Cut But Spending Stays the Same?

Short-Term Boost vs Long-Term Debt

Tax cuts can create an immediate surge in spending and investment. Households have more cash, businesses more profits.

However, if the government maintains spending levels, revenue falls and deficits widen. More borrowing increases national debt and interest obligations.

The Economic Policy Institute warns that extending TCJA provisions could increase the fiscal gap from 2.1 % to 3.3 % of GDP.

Distributional Impact

Tax relief often favors higher earners, who tend to save rather than spend, weakening stimulus effects for Main Street.

Real-World Illustration

A small-business owner benefits from a lower corporate tax rate and hires two employees. Good news—temporarily. But if deficits rise, interest rates may tick upward, increasing loan costs for other entrepreneurs.

Key Takeaway: Tax cuts without fiscal restraint = short lift, long hangover.

What If The Government Spends More Without Raising Taxes?

Higher government spending can drive powerful public investment multipliers—especially when directed toward infrastructure, clean energy, or education.

Yet if financed through borrowing, it adds to debt and interest-payment pressures.

CBO data: Net interest spending is projected to be the fastest-growing budget item in the next decade.

Example: A $300 billion infrastructure bill creates jobs and stimulates local industries. If managed efficiently, it can reduce logistics costs and boost exports for years. If mismanaged or entirely debt-funded, it adds fiscal strain.

Key Takeaway: Spending is only “good” when it is smart, targeted, and efficient.

Which Works Better in 2025—Tax Cuts or Spending Increases?

It depends on context:

| Economic Condition | Better Tool | Why |

|---|---|---|

| Recession / Slack | Tax Cuts or Spending | Boosts demand |

| Full Employment + High Debt (2025) | Targeted Spending | Improves productivity without fueling inflation |

| Inflationary Period | Fiscal Discipline | Avoids overheating |

In 2025, with high debt and solid employment, targeted spending (in innovation & infrastructure) is likely to yield greater long-term benefits than broad tax cuts.

Debt & Interest: The Fiscal Pressure Points

- Debt-to-GDP > 100 % and projected to reach ≈ 118 % by 2035.

- Rising interest rates mean every extra $500 billion borrowed costs ≈ $20 billion a year in interest.

- Opportunity cost: that money cannot fund schools or bridges.

Key Takeaway: Fiscal imbalance limits policy freedom for future leaders.

Do Tax Cuts Always Outperform Spending Increases?

No—context matters.

Tax Cuts Work Best When:

- Targeted to lower/middle incomes (who spend more).

- Designed to encourage investment or innovation.

- Implemented in times of economic slack.

Spending Works Best When:

- Directed to infrastructure, education, and R&D.

- Accompanied by accountability metrics.

- Designed for long-term returns vs short-term politics.

In 2025: With tight labor markets and higher rates, public investment in productive sectors beats broad tax cuts for stimulus effectiveness.

Political & Distributional Trade-Offs

Tax cuts often benefit upper brackets; government spending tends to support lower and middle classes.

| Policy | Who Benefits Most | Equity Impact |

|---|---|---|

| Broad Tax Cuts | High-income earners / corporations | May increase inequality |

| Targeted Spending | Working class / small businesses | Promotes inclusive growth |

2025’s political challenge: Balancing short-term popularity (tax relief) with long-term equity and debt control.

Lessons From History

- 2001–2003: Large tax cuts lifted growth but expanded debt.

- 2009 Stimulus: Spending aid helped recover from recession, but execution varied.

- 2020s: Massive spending and tax relief combined → record deficits.

Lesson: Timing + Targeting = Impact. When debt is high, discipline matters most.

What This Means For Everyday Americans

If tax cuts arrive:

- Use extra income wisely—invest, not just consume.

- Expect possible future tax hikes to offset deficits.

If spending expands:

- Watch for new infrastructure and job opportunities.

- Ensure local leaders use funds efficiently.

Personal strategy:

- Build an emergency fund.

- Invest in skills that align with public investment trends (e.g., green energy, tech).

What Policymakers Should Do

Focus on targeted tax relief that encourages work and investment.

Channel spending to high-ROI areas like infrastructure & education.

Enforce accountability and measurable outcomes.

Adopt automatic guardrails to stabilize debt ratios.

Maintain transparency and long-term planning.

The Winning Fiscal Formula for 2025

The formula is not “tax cuts vs spending”—it’s balance and discipline.

Winning Mix:

- Moderate, targeted tax relief for middle incomes & small businesses.

- Strategic investment in infrastructure, R&D, and climate adaptation.

- Fiscal guardrails to contain debt.

- Equity focus to reduce inequality and enhance social stability.

- Transparent ROI tracking for public projects.

Balanced fiscal policy is how America keeps growth dynamic and sustainable.

Deep Dive Section

A. Tax Cuts in 2025: Scope and Implications

- TCJA extensions continue to dominate the tax agenda.

- Extending major provisions could trim revenues by trillions over the next decade.

- Corporate cuts boost business confidence but also risk revenue erosion.

- Distributional concerns remain: top brackets gain more relief than lower earners.

Bottom Line: Tax cuts can stimulate growth—but must be accompanied by long-term revenue plans.

B. The Case for Government Spending

- Federal spending averaging 24 % of GDP underscores the need for efficiency (BPC).

- Infrastructure and innovation funding drive long-term returns.

- Entitlement growth without reform may crowd out productive investment.

Smart Spending = Strong Future Returns.

C. Balancing Growth, Equity, and Debt

The triple mandate of modern fiscal policy:

- Grow the economy (productivity, innovation).

- Promote equity (opportunity & fairness).

- Manage debt (sustainability).

Failure in any dimension undermines the others. For example, unchecked debt can force austerity that hurts growth and equity.

D. Scenario Analysis

Scenario 1: Broad Tax Cuts, Flat Spending

- Growth boost short term, higher deficits long term.

- Historical echo: 2000s Bush tax cuts increased debt burden.

Scenario 2: Productive Spending Only

- Gradual growth lift with manageable debt if returns are strong.

- Requires strict project evaluation.

Scenario 3: Targeted Tax Cuts + Strategic Spending + Fiscal Discipline

- Balanced approach produces inclusive, sustainable growth.

- Closest fit to the 2025 winning formula.

FAQs – Top Trending Questions Americans Ask

Q1. Will tax cuts always boost economic growth?

Not automatically. The boost depends on the state of the economy, targeting of the cuts, and how they are financed. In 2025’s context—with near-full employment and high debt—the growth impact of broad tax cuts may be muted and come with elevated risks (inflation, debt burden). For example, research shows that extending the TCJA under current conditions would likely hurt working families unless balanced by spending increases or progressive tax changes.

Q2. Are government spending increases always good for the economy?

They can be—but quality matters. Spending on productive assets (education, infrastructure, research) tends to raise long-term capacity and pay dividends. Spending purely on transfers or entitlements without productivity gains may have smaller growth impact and raise debt burdens. The challenge in 2025: ensuring that spending increases are efficient and aligned with strategic objectives.

Q3. How much is the U.S. government debt-to-GDP ratio projected to rise?

According to recent CBO data, the debt held by the public is projected to surpass 100 % of GDP in the current fiscal year and could reach ~118 % by FY 2035 under current law. This high ratio constrains fiscal flexibility and increases risk if growth slows.

Q4. Can tax cuts and spending increases be combined effectively?

Yes, but the combination must be carefully managed. Effective combinations include targeted tax cuts (with productivity incentives) and strategic spending (with measurable returns), along with some offsets (closing loopholes, trimming low-return spending). Without discipline, combining them can lead to runaway deficits.

Q5. How does distribution (income inequality) factor into this formula?

Distribution matters for both fairness and growth. For example, tax cuts that disproportionately benefit the wealthy may yield lower marginal consumption and slower demand stimulus. Meanwhile, spending directed toward lower-income households or disadvantaged regions tends to support inclusive growth. In 2025, balancing growth and equity is key to both legitimacy and social stability.

Q6. What role do interest rates and inflation play in this debate?

When deficits grow and debt rises, risk premiums climb, and interest rates may rise—raising the cost of borrowing for government and private sector alike. Inflation erodes purchasing power and can force central banks to tighten monetary policy, slowing growth. 2025’s context: With higher baseline rates and inflation concerns, excessive deficits carry greater risks than in past decades.

Q7. What are the biggest risks of getting the formula wrong?

- Debt spiral: Rising interest payments crowd out productive investment.

- Growth slowdown: If fiscal policy is mis-aligned, future growth may suffer.

- Inflation spike: Excess stimulus when near capacity can fuel inflation.

- Social inequity: Mis-targeted tax relief or spending may worsen inequality, undermining social cohesion.

Q8. Can spending cuts substitute for tax increases?

In principle yes—but politically and practically, spending cuts are harder if they target sacred programs (e.g., Social Security, Medicare). Additionally, poorly timed cuts in economic downturns can be contractionary. Analysts warn that financing tax cuts with cuts to social benefit programs would hurt working families the most.

Q9. What should voters watch for in upcoming fiscal policy?

- Whether tax relief is targeted (who benefits).

- The financing plan: Are there offsets, revenue raisers, or just borrowing?

- The return on new spending: Are investments in infrastructure, human capital, innovation clearly measured?

- Trends in debt servicing: Is interest spending growing faster than tax revenue?

- Clarity in long-term planning: Does policy acknowledge 10- or 20-year horizon, not just next election?

Q10. Ultimately, which policy direction should we hope for?

A responsible direction would involve:

- Tax relief for middle and lower incomes, incentives for investment and productivity.

- Strategic public investment in areas with long-term growth potential (infrastructure, green tech, education).

- Fiscal discipline: either offsets for tax cuts, priority setting for spending, and automatic mechanisms to keep debt in control.

- Ensuring that growth is inclusive: benefits widely shared, not just captured by a few.

Conclusion: Beyond the Binary Debate

In 2025, America must move past the zero-sum fight between tax cutters and spenders. Fiscal success lies in a data-driven middle path—combining efficiency, equity, and accountability.

The choice isn’t tax cuts or spending. The choice is smart vs reckless.

And the real winners? Citizens who benefit from both economic freedom and shared prosperity.